Industry News

The development of RF coaxial connectors

The Internet of Things, 5G and advanced technologies across markets require smaller, higher performance RF coaxial connectors.

In today's new applications, economic and technological advances will change significantly, enabling the next generation of components to innovate. Despite the uncertainty created by the COVID-19 pandemic, advanced technologies from 5G and the Internet of Things, new threats from signals intelligence and electronic warfare in military and space, coupled with trends in miniaturization, commercial off-the-shelf (COTS) connectors, and advances including testing, interactive machine-to-machine (M2M) production, and connected vehicles, are making it possible to improve the quality of the vehicle. So that this period of RF coaxial connectors face a huge challenge.

The COVID-19 pandemic has exacerbated supply chain problems. Material and process challenges are an ongoing problem. For example, in order to meet EU regulations, low passive crossmodulation (PIM) is achieved using arsenic gold hardener to increase electrolytic polishing. Today's advanced technological requirements drive the development of design and production. For microwave and high-frequency applications, test reports should be obtained to confirm performance.

Suppliers of electrical connectors, especially RF coaxial types, continue to develop new varieties to meet industry needs and keep up with application developments. Most RF coaxial connectors are available for many different applications and markets. This makes it difficult to define end-use applications and markets. For example, the same 2.92mm connector can be used for radio and test equipment for medical imaging devices and satellites, while the new E-band 1.35mm connector is suitable for 5G backhaul systems, connecting microwave components, test systems including vector network analyzers (VNAs), and autonomous vehicles, among others. New RF connectors are being designed. Anritsu's 0.8mm connector replaces waveguides and supports frequencies above 145GHz.

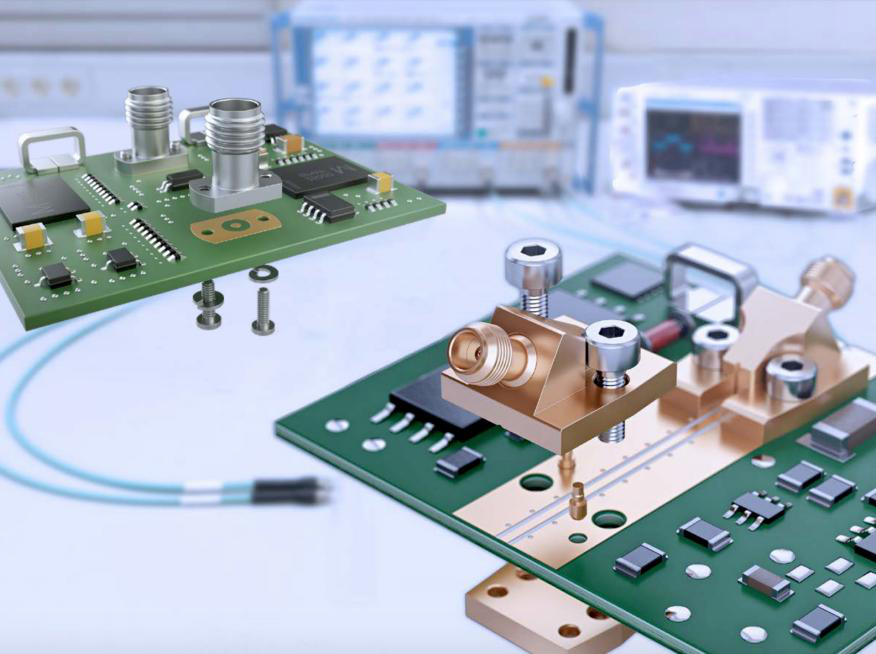

Rosenberger PCB connectors

Rosenberger offers a broad product range of solderless PCB connectors designed to meet challenging test and measurement needs. Products include cost-effective solderless PCB connectors for standard applications with frequencies up to 70GHz, high-performance solderless PCB connectors for frequencies up to 110GHz, and PCB connectors, among others.

The development of the new connector is inspired by 5G and the Internet of Things

Rf coaxial connectors are increasingly important because the number of communication and wireless enabled devices and the amount of data are growing at an alarming rate. It is predicted that there will be more than 2.7 billion 5G connections globally by 2025 (according to CCSInsights). The COVID-19 pandemic has slowed down the standardization needed to deliver 5G to businesses. Although the COVID-19 pandemic has led to a slowdown in 5G construction, the trend of rapid growth remains unchanged.

Bishop & Associates predicts that by 2025, 21% of all cellular connections worldwide will be 5G, which offers tremendous potential for RF coaxial connectors. Ultra-small board to board (B2B) for handheld and mobile devices; Higher power and lower PIM connectors for base stations; V-band and E-band interconnections for larger bandwidth backhaul sites, as well as all associated infrastructure equipment, cables and adapters, will see strong growth.

The market for 5G small batteries will be one of the fastest growing 5G segments. Facilities may be 100 yards apart in densely populated areas or in larger buildings. This will involve new coaxial connector families such as the NEX10, 2.2/5 and 1.5/3.5DIN, as well as multi-port components for antenna housings, among others, which can come in more than 30 types.

I-PEX MHF7S connector

The I-PEX MHF7S connector has a 2.0x2.0mm reservoir with a maximum matching height of 1.40 and has a unique shielding design, especially to reduce EMI in 5G millimeter wave applications. They exhibit a maximum VWR of 1.5 at 15GHz.

COVID-19 is expected to lead to a shift in the way business, education and business are done. The Internet, telecommunications, cybersecurity (commercial and military), unmanned aerial vehicles and other developments will increase the demand for new application solutions involving RF devices and change. The change in frequency will have more functionality in smaller devices, and the future of RF coaxial connectors looks great. But which connectors will be in high demand and offer the best return on investment?

As the frequency increases, the design, production tolerances, test equipment and methods all become more complex. They are usually divided by frequency. For example, 40GHz 2.92mm should be more profitable than 20GHz SMA. Low frequency connectors are usually larger in number, with simpler technology and lower cost. As a result, most high-performance microwave and millimeter wave products are manufactured in the United States or Europe, while most low-frequency RF interconnect products are currently manufactured in Asia.

Major suppliers of miniature board-to-board or wire-to-board RF coaxial connectors include Hirose, I-PEX, and JAE, plus Amphenol, Molex, and Samtec in the United States, as well as European suppliers such as Radiall and Rosenberger. China is able to provide higher frequency connectors, but its stainless steel may have residual magnetism and surface corrosion, alloy impurities, etc.

Rf technology is driving growth in many markets, and several market emerging areas have unique growth potential. 5G communications will use the redefined E-band for backrange transmission, driving the development of microwave connectors up to 92GHz, while expanding the market for low-frequency standard and low-PIM connectors such as 4.1/9.5 "mini-DIN", N, 7/16 and 4.3/10. Mobile 5G and iot devices will also expand the need for automated production and installation of micro RF coaxial connectors such as U.L, X.L, MHF/PCIe, as well as micro devices such as MMCX and HD-BNC, primarily for 6GHz. High-speed video and surveillance drones for the 2021 Olympics will require new 18G Hz, 75Ω coaxial connectors and cables.

With the development of emerging applications, coaxial connectors are also innovating. The new FAKRA-mini version on the vehicle will run to 17GHz. Phase-guided antennas, progressively smaller instruments, and 5G new radios (NR) will increase the use of miniature blind plug connectors such as SMP3. Larger commercial components can be added with new connectors as per VITA67.3. The recently formed SOSA Association is in the process of identifying additional VITA Open-VPX connectors for military projects. Leading-edge test equipment will be expanded using coaxial plugs and flyover assemblies. Rf connectors are also being designed to replace waveguides, for example, Anritsu's 0.8mm connector supports frequencies above 145GHz.

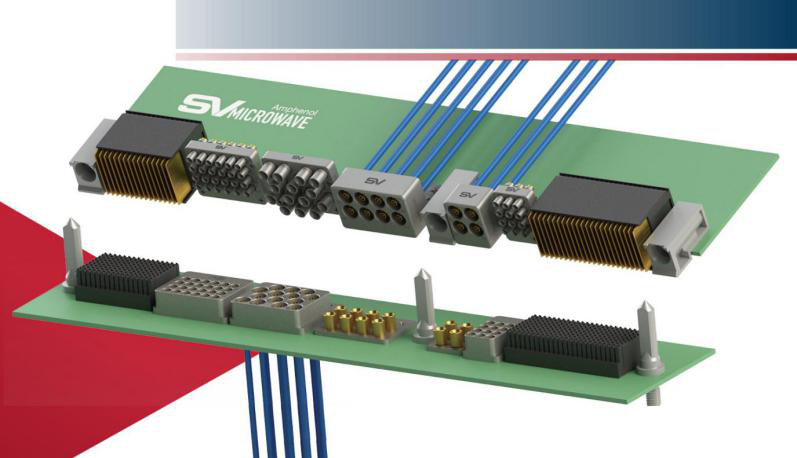

SV Microwave's VITA67.3 standard product line

SV Microwave's VITA67.3 standard product line is the latest addition to the RF/ coaxial portion of the VPX platform. These customizable RF solutions are ideal for embedded system applications. SV Microwave is a member of the OpenGroup Association and an active participant in the SOSA Electromechanical Hardware Organization.

With the expansion of the use of RF coaxial connectors, people's concerns include:

* Due to the impact of COVID-19, supply chain restarts lead to slower delivery and will retarget Asian sources.

* Extended time for finalization of 5G and iot specifications.

* Uncertainty over military and government budgets.

* U.S. import and export policies and potential tariffs on China.

Competitive negotiations on new international connector standards (especially IEC) and the use of additional frequency bands.

* Cost of new test equipment and lead-in time.

Availability of quality cables and cable assemblies for high frequency applications.

The impact of counterfeit connectors and cables, including counterfeiting, uncertified materials, bypassing testing, and unapproved procurement. (Estimates of counterfeit content in the U.S. connected supply chain range from 15 percent to 65 percent per GAO and DLA/S-DSCC input.)

Suppliers are required to meet a variety of product certifications, from expanded EU REACH and SEC Conflict Materials to California Prop. 65 and more.

Emerging areas such as the Internet of Things, 5G, and artificial intelligence will promote the innovation and development of new RF coaxial connectors.